Financial Aid Document Examples

The Smart Choice

Academic Transcript

Copy of your OFFICIAL academic transcript from your high school and/or previously-attended college/university. We are unable to accept unofficial transcripts (i.e. screen-captures, pictures and scans of documents) and require the official transcript. This can be sent as a PDF attachment from you or the school itself, or dropped off in person at Student Central if you requested a paper copy.

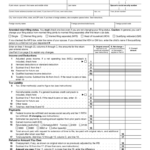

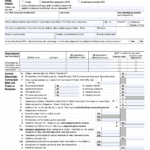

Tax Returns

A SIGNED COPY of your official tax return. There must be a signature on the signature line; failure to sign will result in an incomplete form and can cause delays in your financial aid. This can be submitted as a PDF scan, image, or dropped off to Student Central in person. You may also be required to submit all associated tax schedules and 1098s/1099s, if applicable.

If you do not have access to your tax return, please see here for other acceptable documents: Tax Form Quick Reference.

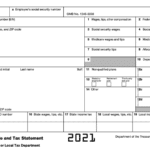

W-2 Forms

Copy of your W-2s. Please submit all applicable W-2s for the total year. If you do not have access to your W2, please see here for other acceptable documents: Tax Form Quick Reference.

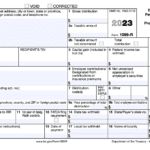

1040-X Amended Tax Return Form

Submit a copy of your form 1040-X, also known as an Amended Tax Return. This can be submitted as a PDF scan, image, or dropped off to Student Central in person. If you do not have access to your tax return, please see here for other acceptable documents: Tax Form Quick Reference.